It’ll be like winning the lottery for those in WV but a slap in the face to those in metro areas.middle class is gonna get screwed on these checks again and will have to pay them back. The government has no idea what a high income person is. A couple in NYC that is filing joint making $151K a year is not middle class as these people should get the checks. It is expensive there, CA, CT and many other states. It does matter if a republican or democrat is in office, middle class gets screwed and we have to survive this stuff and get nothing from government. tighten up the belt boys before they bend you over.. Sorry for the political rant and I will ban myself for a few days.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Midwest

- Northeast

- Other

- Southeast

- West

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

So are these stimulus checks..

- Thread starter ThatNehlenFeelin

- Start date

Actually about 44% of Americans don’t pay any federal tax.[/QUOTE]Everyone doesn't pay taxes?

Be careful... liberals don’t want that secret to get out.

I'm in NJ & didnt get shut down but for 1 day .I’m single and make over the thresh hold for a person filing single and I’m fine with that. What they did do for people like myself who work through a union hall and have been laid off bc of the outbreak, is extend our unemployment benefits 13 weeks on top

Of the normal 26 weeks available to us yearly. Also they are allocating $600 additional a week for four months to compensate the eligible workers who are out of work. In NJ the weekly full rate of UI is $713. Basically I will get 2/3rds of my weekly take home until this is over. My medical insurance is also safe for 22 months from the last day I worked so I gladly won’t worry about the one time payment from the govt. I’m sure someone needs it more then I do and hope it helps someone and their family.

I hope your insurance is good enough to limit the strain a hospital visit would incur with this virus.I’m single and make over the thresh hold for a person filing single and I’m fine with that. What they did do for people like myself who work through a union hall and have been laid off bc of the outbreak, is extend our unemployment benefits 13 weeks on top

Of the normal 26 weeks available to us yearly. Also they are allocating $600 additional a week for four months to compensate the eligible workers who are out of work. In NJ the weekly full rate of UI is $713. Basically I will get 2/3rds of my weekly take home until this is over. My medical insurance is also safe for 22 months from the last day I worked so I gladly won’t worry about the one time payment from the govt. I’m sure someone needs it more then I do and hope it helps someone and their family.

Be careful... liberals don’t want that secret to get out.[/QUOTE]Actually about 44% of Americans don’t pay any federal tax.

Back it up with data or it's another cancervative talking point

More than 44% of Americans pay no federal income tax

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

Back it up with data or it's another cancervative talking point[/QUOTE]Be careful... liberals don’t want that secret to get out.

https://www.taxpolicycenter.org/mod...x-liability-september-2018/t18-0128-tax-units

going to be taxed?

I owe taxes guess I won’t get one

of course I can't go to the gym.. injured my ankle( my whole foot was purple even my toes).so my gait changed which hurt my fkn back..can't go to the hot tub at the gym so I ordered one of those inflatable hot tubs along with a gazebo. would have made the deck too crowded so fk it..the back yard it is.

It’ll be like winning the lottery for those in WV but a slap in the face to those in metro areas.

Us West Virginians win the lottery every day cause we live in WV. But those in metro areas wish to be like us. God blessem’ all I say! #Trump2020

https://www.taxpolicycenter.org/mod...x-liability-september-2018/t18-0128-tax-units[/QUOTE]Back it up with data or it's another cancervative talking point

I take that to mean that 44 % of Americans don't make enough money to pay taxes. I saw that 12.5 % of American families make below the poverty line of $ 24,500 so they do not pay but apparently there are many who still have enough deductions and credits to pay 0. I don't see anything wrong with being in that group.

My job laid off Friday. And the chances are hopefully I will be back to work in maybe a week or so.I'm in NJ & didnt get shut down but for 1 day .

Phenomenal insurance, to the tune of $25k-$30k a year paid into the plan by the contractors I work for. And with 1000 local members plus hundreds of members from other parts of the the state and country working at any time, our health plan is very very strong. Let’s hope we all stay healthy and don’t have to use it.I hope your insurance is good enough to limit the strain a hospital visit would incur with this virus.

Isn't that what the 500 billion for hospitals is for? I don't know why everfybody assumes that there's not going to be some decent treatments forthcoming and the number of people in ventilators never reaches an extreme amount.What I saw this morning:

Anyone over 75k individual, 150k joint is expected to pay back over 3 years, 0 interest

$7,500 cap per family

I don't get this means testing bullshit but when you have a Congress loaded with people too afraid to spend or absolutely against any spending, this is the kind of stuff we get stuck with. Like I said before, I couldn't care less about this money and would rather funds cover people's ICU costs.

People can relocate to an area that isn't as expensive but then the pay is lower.middle class is gonna get screwed on these checks again and will have to pay them back. The government has no idea what a high income person is. A couple in NYC that is filing joint making $151K a year is not middle class as these people should get the checks. It is expensive there, CA, CT and many other states. It does matter if a republican or democrat is in office, middle class gets screwed and we have to survive this stuff and get nothing from government. tighten up the belt boys before they bend you over.. Sorry for the political rant and I will ban myself for a few days.

Laid off Friday, called back Saturday. I'm outside & only person I'm in close contact with is my helperMy job laid off Friday. And the chances are hopefully I will be back to work in maybe a week or so.

middle class is gonna get screwed on these checks again and will have to pay them back. The government has no idea what a high income person is. A couple in NYC that is filing joint making $151K a year is not middle class as these people should get the checks. It is expensive there, CA, CT and many other states. It does matter if a republican or democrat is in office, middle class gets screwed and we have to survive this stuff and get nothing from government. tighten up the belt boys before they bend you over.. Sorry for the political rant and I will ban myself for a few days.

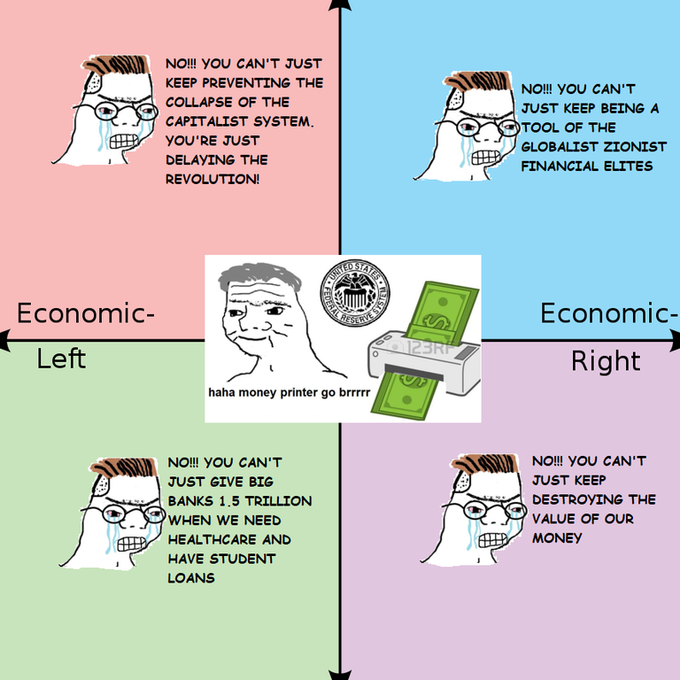

For a couple it's $198k maximum income. It is not a loan, it is effectively a grant. I will get $1,200 which I will use to pay off two bills. That effectively gives me an increase in disposable income indefinitely. I will prudently spend half of my increased monthly net on women and booze, I'll probably just blow the other half.

Nice. Where are you working? What trade?Laid off Friday, called back Saturday. I'm outside & only person I'm in close contact with is my helper

That is absolutely hilarious. You obviously don't understand the economy and what happens if the flow of money stops. What you really don't understand is what Nancy Pelosi tried to put in the Bill to save the economy. She want to spend Billions on her pet projects, Planned Parenthood, Kennedy Center, Public Democrat television. Millions for Illegals, Millions for a raise for the House of Delegates. Does that sound fiscally conservative?90% of America is getting a somewhat free check (I’m sure it will get taxed). The republicans turned into socialists & Dems suddenly became fiscally conservative.

Well played Corona. Well played.

Is a “helper” the same as a “fluffier”?Laid off Friday, called back Saturday. I'm outside & only person I'm in close contact with is my helper

More than 44% of Americans pay no federal income tax

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

I feel like it all kind of equals out in the end.

They do pay social security taxes, medicare taxes, state taxes, etc. So implying the poor don't pay taxes on their earnings is misleading. They just don't pay one segment of taxes, which, to be fair, is the highest percentage of tax that needs to be paid.

On the other hand, they have to pay social security taxes on all of their income. Once you go over $137k in taxable income, you no longer pay SSI tax. That's a fact a lot of people don't realize as well.

For a couple it's $198k maximum income. It is not a loan, it is effectively a grant. I will get $1,200 which I will use to pay off two bills. That effectively gives me an increase in disposable income indefinitely. I will prudently spend half of my increased monthly net on women and booze, I'll probably just blow the other half.

The Elf said:

↑

More than 44% of Americans pay no federal income tax

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

I feel like it all kind of equals out in the end.

They do pay social security taxes, medicare taxes, state taxes, etc. So implying the poor don't pay taxes on their earnings is misleading. They just don't pay one segment of taxes, which, to be fair, is the highest percentage of tax that needs to be paid.

On the other hand, they have to pay social security taxes on all of their income. Once you go over $137k in taxable income, you no longer pay SSI tax. That's a fact a lot of people don't realize as well.

[/quote]

Everybody should pay something. Even if it’s a dollar. Nobody should get a tax refund larger than the federal tax they paid in. That’s called welfare.

Plus they get hit the hardest by sales tax, gas tax, sin tax, auto registration fees, utility deposits, etc.. SS cap needs lifted then SS will be funded forever.I feel like it all kind of equals out in the end.

They do pay social security taxes, medicare taxes, state taxes, etc. So implying the poor don't pay taxes on their earnings is misleading. They just don't pay one segment of taxes, which, to be fair, is the highest percentage of tax that needs to be paid.

On the other hand, they have to pay social security taxes on all of their income. Once you go over $137k in taxable income, you no longer pay SSI tax. That's a fact a lot of people don't realize as well.

Not sure if I’m going with the Mossberg 590M w/ heat shield 12 gauge tactical shotgun with 10 round clip or a CAP 5-100 pound sets of rubber hex head dumbbells.

One will be a few hundred back in my pocket and the other will be about a grand out of pocket. Since the virus both are actually in high demand.

Shotgun...keep forever. Prolly get barely used. ...but one time might really matter.

Weights just until gym opens but a couple years of gains feel like they’re going away by the day.

Both could be sold later with modest (50%) monetary loss.

One will be a few hundred back in my pocket and the other will be about a grand out of pocket. Since the virus both are actually in high demand.

Shotgun...keep forever. Prolly get barely used. ...but one time might really matter.

Weights just until gym opens but a couple years of gains feel like they’re going away by the day.

Both could be sold later with modest (50%) monetary loss.

Digging into that of the 44% a chunk of that number(40%) are retiress who don't earn enough to pay income taxes so as usual the stats are used in a misleading way unless you don't care if those retirees have to choose between their prescriptions or eating cat food and just lump them into the "takers" category.More than 44% of Americans pay no federal income tax

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

I won't qualify for much of anything, but does the $500 per child still apply, regardless of income?

I won't qualify for much of anything, but does the $500 per child still apply, regardless of income?

I think it is tied to the income restrictions, but don't quote me on that.

I think it is tied to the income restrictions, but don't quote me on that.

I just quoted you on that...

Not that I need it, but if I did get something I plan on prepaying for various things like haircuts, etc... to help out the people who can't work that I deal with.

going to be taxed?

Not taxed.

Not a good idea.

To me, we should have used the money going out to individuals to bolster unemployment income so if you do get laid off you get all of your income instead of just a small portion.

The loans to businesses and such... Fine with that.

I'd also given you a bigger tax deduction in 2021 for any medical expenses you had related to coronavirus.

Too late now though... We got what we got and the middle class will have to pay for it like always.

Not taxed.

Not a good idea.

To me, we should have used the money going out to individuals to bolster unemployment income so if you do get laid off you get all of your income instead of just a small portion.

The loans to businesses and such... Fine with that.

I'd also given you a bigger tax deduction in 2021 for any medical expenses you had related to coronavirus.

Too late now though... We got what we got and the middle class will have to pay for it like always.

I didn't have a whole lot of problems with it. Something needs done or we will all be in bad shape in 6 months. I would have like to seen the payment start at 2000 then scale down to 1000 at the 100k mark. Basically give the lower incomes more, they are the people who are really hurting. For full disclosure, I will receive it but I am at the very top of the cutoff before it starts scaling down.

The Senate also bolstered the weekly cap on unemployment insurance and did some other things on the business side that will help them keep people on payroll. The relief payments to individuals are just one part of the equation.Not taxed.

Not a good idea.

To me, we should have used the money going out to individuals to bolster unemployment income so if you do get laid off you get all of your income instead of just a small portion.

The loans to businesses and such... Fine with that.

I'd also given you a bigger tax deduction in 2021 for any medical expenses you had related to coronavirus.

Too late now though... We got what we got and the middle class will have to pay for it like always.

The bill that I read stated no American would pay out of pocket for care related to coronavirus, so I’m not sure where you all are getting that people will be stuck with huge medical bills from this.

Actually about 44% of Americans don’t pay any federal tax.[/QUOTE]Everyone doesn't pay taxes?

Does that count Amazon,Chevron and the 58 other companies that didn't pay any taxes.

The bill that I read stated no American would pay out of pocket for care related to coronavirus, so I’m not sure where you all are getting that people will be stuck with huge medical bills from this.

Not so much getting stuck with medical bills as much as we have to pay back 2000000000000

This isn't free money.

Not so much getting stuck with medical bills as much as we have to pay back 2000000000000

This isn't free money.

The national debt is bogus anyway

There was also 60 large companies that paid no tax Amazon was one of them.More than 44% of Americans pay no federal income tax

By Quentin Fottrell

Published: Feb 26, 2019 5:45 am ET

The Tax Policy Center estimates how many people paid no federal individual income taxes in 2018

Similar threads

- Replies

- 0

- Views

- 274

- Replies

- 0

- Views

- 332

- Replies

- 0

- Views

- 156

- Replies

- 2

- Views

- 183

- Replies

- 1

- Views

- 106

ADVERTISEMENT

ADVERTISEMENT