Hunter Biden Owned Financial Stake In Digital Banking Platform For Undocumented Migrants, Introduced Founder To Joe Biden While Company Received Mexican Government’s Endorsement.

EXC: Hunter Biden Owned Financial Stake In Digital Banking Platform For Undocumented Migrants, Introduced Founder To Joe Biden W

ePlata, a digital banking platform partnered with the Mexican government to enable migrants to send and receive remittances, has deep

warroom.org

warroom.org

ePlata, a digital banking platform partnered with the Mexican government to enable migrants to send and receive remittances, has deep financial and personnel ties to Hunter Biden.

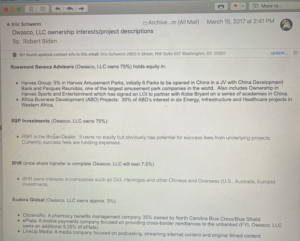

The fintech startup describes itself as a “multi-balance, multi-currency digital wallet and payment ecosystem” and was founded by one of Hunter Biden’s long-time business partners Jeff Cooper. Documents unearthed from Hunter Biden’s hard drive also reveal that the president’s son held an 8.25 percent stake in ePlata through his company Owasco LLC, though it is unclear if he still retains the position.

Several individuals who have financial ties to Hunter Biden, however, have recently been appointed to the company’s Board of Directors.

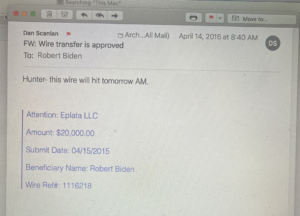

Emails obtained from Hunter Biden’s hard drive prove the president’s son was profiting off of ePlata, receiving a $20,000 wire transfer from the company in April 2015.

ePlata “offers worldwide banking without the need for a traditional bank account,” continues a company synopsis, which also raises concerns about the platform potentially being used for money laundering and other criminal activities including human trafficking.

While ePlata was launched in 2016, in recent years it has made broader efforts to grow, including appointing several Hunter Biden-linked individuals to its Global Advisory Board in 2019.

ePlata also appears to have a financial interest in supporting mass migration to the U.S. given the company positioning itself as the premier platform for sending and receiving remittances. In emails obtained from Hunter Biden’s hard drive, the company pitched itself as “focused on providing cross-border remittances.”

Remittances represent a key financial aspect of mass migration – both legal and illegal – as it refers to migrants sending funds from their current country of residence back to their home country. The payments constitute a massive industry worth over $150 billion annually in the U.S. alone and harm America’s economy, as the sizable sum leaves the country untaxed.

Mexico consistently ranks as the top destination for outbound remittances from the U.S., and nearly 95 percent of inbound remittances to Mexico come from migrants living in the U.S.

ePlata has made the controversial form of payment a cornerstone of its business, highlighting how the platform can be used for “cross-border remittances” on the front page of its website:

Contrary to traditional bank regulations, ePlata appears to make sending and receiving money easy for users, including illegal aliens, given its lax identification requirements for signing up.“Labor moves around the globe, and when workers move so does their money. The global nature of labor often makes it difficult for someone to have a bank account in the country where they are employed. This is why ePlata allows you to transact in the currency of your choice and without limits across geographic borders. Is there any reason money transfers should be more expensive because one person lives in a different country? ePlata does not think so. With ePlata, simple, secure and inexpensive international transactions are now in the palm of your hand.“

“You can then create an ePlata account by simply entering your name, address, email address and mobile number. That’s it, no hassle, no pain, no cost. With ePlata, setting your money free is as easy as one, two, three,” explains a summary of the platform’s onboarding.

The company’s emphasis on remittances comes amidst its 2019 partnership with the Mexican government whereby the Office of the Federal Prosecutor for the Consumer, which falls under the auspices of the Mexican Attorney General, selected ePlata as one of two fintech companies it endorsed for citizens to send and receive remittances.

The head of Mexico’s Consumer Protection Agency also highlighted ePlata as one of the country’s leading platforms for sending and receiving remittances during a presidential press briefing.

Jeff Cooper, the founder of ePlata, and Hunter Biden have a long history of collaboration, including on some of the president’s son’s most controversial business dealings implicating Joe Biden exposed through his “Hard Drive From Hell.”

While pursuing deals with Mexican billionaires during Joe Biden’s tenure as Vice President, Cooper and Hunter Biden exploited the privileges of the office – including White House Events, trips on Air Force Two, and meetings with Joe Biden – to lure clients.

Cooper, who has appeared in photos with Hunter, Joe, and various Mexican billionaires, even joined Hunter on a February 2016 Air Force Two flight to Mexico.

Hunter Biden and Cooper had previously worked together trying to raise funds from Mexican billionaire Carlos Slim for their venture Ocho Gaming, which a whistleblower recently revealed that Joe Biden was involved in as a “silent investor.”

The hard drive also reveals that as late as 2018, Hunter Biden and Cooper were still soliciting money from the Slim family with the assistance of Joe Biden.

“Spoke to my dad about ‘Slim ask,’ ” Hunter wrote Cooper after a visit from his father in Los Angeles. “Oh that sounds SO F’ING GOOD” replied Cooper.

ePlata appears to still maintain its links to Hunter Biden, appointing three individuals to its eight-person board in addition to Cooper who are linked to the president’s son.

Among the members of the advisory board is Vuk Jeremic, a former President of the United Nations General Assembly who became a consultant for Chinese energy giant CEFC, which partnered with Hunter on a multi-million-dollar oil and gas deal.

Board member Miguel Aleman Magnani was also engaged in business deals with Hunter Biden which eventually led to him meeting then-Vice President Joe Biden.

“I have brought every single person you have ever asked me to bring to the F’ing White House and the Vice President’s house and the inauguration and then you go completely silent,” Hunter Biden wrote in an email to Magnani, alluding to his exploitation of his father’s political office on behalf of his business partners.

“I don’t know what it is that I did but I’d like to know why I’ve delivered on every single thing you’ve ever asked – and you make me feel like I’ve done something to offend you,” he added.

Fellow Board Member Xin Wang is a Managing Director at BHR Partners

Xin Wang is also on the board of ePlata, concurrently serving as a Managing Director BHR Partners, a highly controversial joint venture between an investment fund founded by Biden and Obama-era Secretary of State John Kerry’s stepson and the state-owned Bank of China.

The president’s son pledged to divest of his 10 percent stake in BHR Partners in 2019, which was notoriously birthed less than two weeks after Biden traveled to China alongside his father and then-Vice President, but reportedly still owns 10 percent of the fund.

In addition to the aforementioned Hunter Biden links plaguing ePlata, perhaps the biggest conflict of interest is the fact that the company benefits from Joe Biden’s failure to secure the southern border and continued enabling of unprecedented levels of legal and illegal immigrants to enter the U.S.

As this population grows, ostensibly ePlata’s profits through more remittances being sent and received increase, too.

ePlata’s expansion – which includes collaboration with governments in countries such as Mexico – also overlaps with the agenda of groups such as the World Economic Forum (WEF) and G20 to roll out “digital identity” infrastructure worldwide.

Once in effect, these systems have often laid the groundwork for China-style “social credit” scoring systems and even vaccine passports.