The Federal Reserve on Wednesday raised its benchmark interest rates by 75 basis points – or 0.75 percentage point – in its latest battle against Bidenflation.

The latest hike will bring the fed funds rate to a range of 2.25% to 2.50%, CNBC’s Steve Liesman reported.

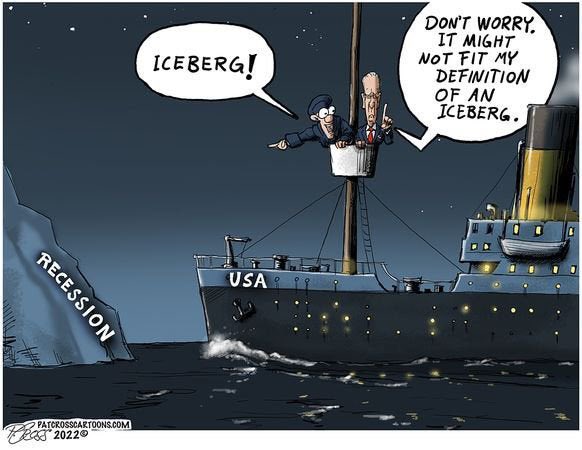

This is the second rate hike in just over a month as the US economy officially enters a recession.

“Growth and consumer spending has slowed significantly in part reflecting lower disposable income and tighter financial conditions,” Fed Chair Jerome Powell said.

lol...

The latest hike will bring the fed funds rate to a range of 2.25% to 2.50%, CNBC’s Steve Liesman reported.

This is the second rate hike in just over a month as the US economy officially enters a recession.

“Growth and consumer spending has slowed significantly in part reflecting lower disposable income and tighter financial conditions,” Fed Chair Jerome Powell said.

lol...